Apple Pay VS Google Pay | Which one is right for you?

It will be wise to say that apple and google are the two tech giants. They both never fail to bring ease into their respective customers’ lives. To remain competitive in the market, both successful enterprises are trying their level best and coming up with brand-new technologies.

Nowadays, Services like apple pay and google pay have made the payment procedure more convenient. Both of these are mobile payment systems. These services provide user with an environment in which user doesn’t need to keep cash with him. You can make digital payments using apple pay or google pay. All you need to do is to know every single detail of these payment services and keep your device with you.

If you are curious to know how these two services work then read the whole blog and decide which service appeals to you the most.

Release dates

Apple introduced Apple pay in 2014.

Google introduced Google Pay in 2018 that replaced the old google wallet.

Similarities between apple pay and google pay

Users can find a lot of similarities between apple pay and google pay.

Contactless payment method:

Both systems work on a contactless payment method which is a wireless financial transaction method. In contactless payment system, customer taps the payment card or device near a point-of-sale terminal. Contactless payment technology is installed in the point-of-scale terminal.

Usability:

Both can be used in stores, in apps, and in online purchases.

Card details:

Both of these systems allow users to upload their credit card, debit card, and loyalty card information into their mobile phones.

Technology:

Both systems use the same technology and that is near-field communication technology (NFC). Customers can make payments without the payment terminals of the merchant.

Consumer’s fees:

Apple pay and google pay services do not charge fees.

Difference between apple pay and google pay

Service compatibility

Apple pay:

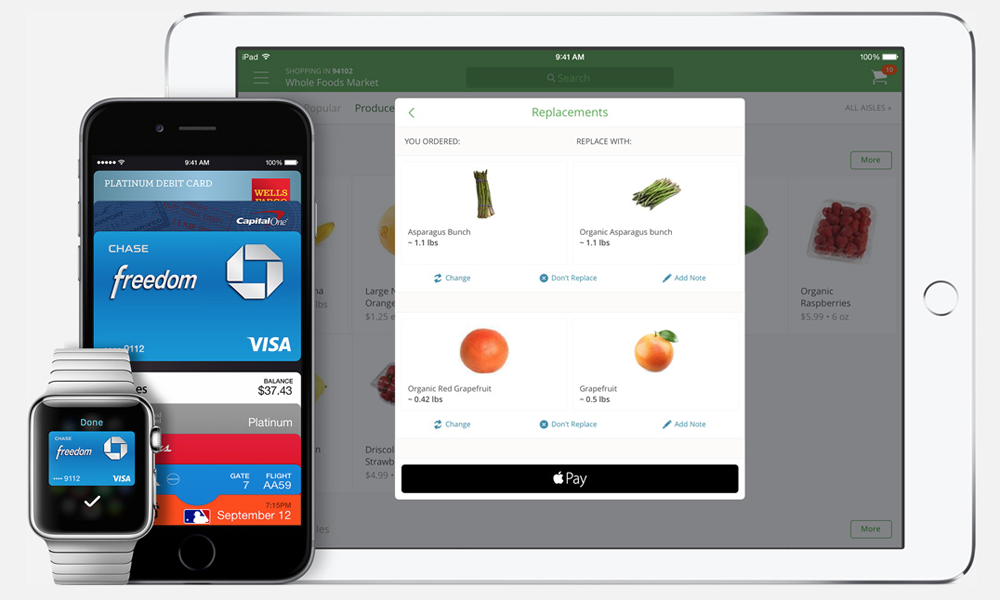

You can only use this payment system on apple devices that have Touch ID or Face ID including apple watches, iPhones, and iPads.

Google pay:

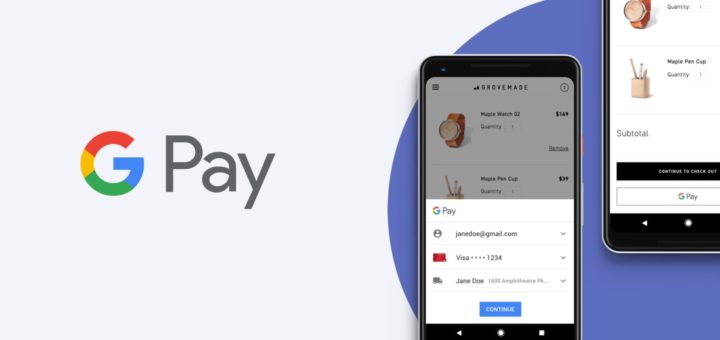

Google pay service is available to android users as well as iOS users. It is compatible with android based smartwatches and android mobile devices.

Security

Apple pay:

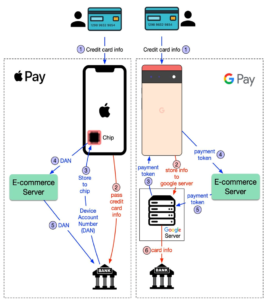

After receiving your credit card information for the first time, Apple passes it directly to the issuing bank without storing it. After confirmation, bank returns DAN (Device account number) token to the iPhone. DAN is a device and card-specific token. It is then stored in a secure hardware chip in your device. After clicking the pay button, the DAN is passed to the bank through the e-commerce server.

Google pay:

On the other hand, if you pay with google pay on your android phones, google pay stores your credit card info in the google server when you register your credit card with google. Google pay issues you a google pay virtual card. It does not allow a vendor to see your actual card. The system only transfers the virtual card information. On clicking the pay button, your payment token is sent to the google server through the e-commerce server. The google server transfers this credit card information to the bank after looking it up.

Installation of the app

Apple pay:

If you are iPhone, iPad, or apple watch user and your device have a touch ID or Face ID then you do not need to download the apple pay app. Apple pay technology is pre-installed on these devices.

Google pay:

To use the google pay service, a user must download the google pay app to their devices.

Payment procedure

Apple pay:

Apple pay allows users to make peer-to-peer payments on their devices using apple cash through the messages app. Users can also ask Siri to pay using a debit or credit card stored in the app.

There are ways in which users can authenticate the transaction when purchasing with an iPhone. These ways include resting the finger on the touch ID, entering the passcode for iPhone, and looking at iPhone’s screen for the face ID. After the authentication is completed, bring your iPhone near the NFC reader and hold it until the transaction proceeds. Your screen will show “done” with a check mark.

Incase, you are making a payment with your apple watch, double-click the side button. Hold the watch display close to the contactless reader.

Google pay

Google pay allows users to send money to a phone number, or email address on an iOS or android device.

In google pay, users can make the in-app purchase without even opening the google pay app. You just need to unlock your phone and hold it close to the contactless payment reader. After the transaction is completed, the blue checkmark will be visible on the user’s screen.

You will need to open the google pay app in case you are making the payment with your smartwatch. Open the app and hold it near the terminal until you hear a buzzing sound. The user may be asked to select “credit” or enter the PIN for the debit card to complete the payment.

Authentication system

Apple pay:

Apple has better control over its hardware. Apple has made this service available on its apple devices that have face ID or Touch ID. Apple pay verifies through face ID or Touch ID.

Google pay:

On the other hand, google works on older hardware. It chooses the typical PIN-based authentication system.

BENEFITS

Ease of transaction:

Apple pay and google pay automatically handles the entire purchasing process with prefilled details of cards. Users can make a direct online purchase from an app or website. A user just needs to enter the PIN, Touch ID, or Face ID.

Time-saving:

Now you don’t need to wait for a long time because apple pay and google pay are very time-saving services. These services allow you to make quick checkouts.

Security:

Both systems don’t disclose your card details to the vendors and promise to give you 100% security.

Free of cost:

One of the most important benefits for the user is that apple and google pay services are free.

Send and receive money using google pay without involving the bank

Google pay does not make any deals with the bank. You can add any card to your google pay. Along with debit and credit cards, you can also add loyalty cards and gift cards. You can send and receive money directly without involving the bank.

Cons of using apple pay and google pay

Mobile payment acceptance:

Not all retailers use mobile payment terminals. It can stop you from making digital payment. Moreover, the apple pay service is not available in all countries. So sometimes you need to keep your cash in hand with you.

Software bug:

Sometimes you might face an issue with an installed software during the payment. This issue can also happen due to software release failures.

Technical glitches:

Most of the time technical glitches in some machines cause issues while making payments.

Training and upgrading cost:

The technology gets more advance over the time. Every time the technology upgrades, it will require upgrading your system and training your staff. All these things require extra cost.

Apple pay enabled phones are expensive:

Apple pay-enabled phones are comparatively expensive. In the case of apple pay, apple is the payment medium alone. If it is lost somewhere or its battery is drained off then, it becomes useless.

Limited use of apple pay service:

Apple pay service is solely used for apple devices which makes its use limited.

Final thought which one is better?

Apple pay and google pay both are great options for contactless payments. Security and ease of use are the matters of major concern for a user, and they both are highly secure. It is a matter of personal preference to choose between the two because both systems offer quite similar services with very little difference.

Author